Central Bank Responses to COVID-19

The global Financial Crisis of 2007-09 sprang from very different underlying causes from the recent COVID-19-related financial market turmoil. In both cases, central banks acted swiftly to maintain financial stability and ease monetary policy; but their recent actions have often surpassed their responses to the previous crisis. This essay summarizes the recent coronavirus-related policy reactions of the Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England (BOE), and the Bank of Japan (BOJ).

The spreading coronavirus has disrupted business activity and created great uncertainty, which reduced asset prices around the world and prompted investors to sell risky assets and buy safer assets, such as Treasury securities. This was particularly true from March 9 to March 26, 2020, when financial market conditions did resemble those of late 2008. These sales of risky assets pushed those prices down further, reducing the net worth of potential borrowers, which made lenders reluctant to lend to these less creditworthy borrowers. By making short-term credit available at a modest cost, absorbing credit risk, and reducing the cost of long-term borrowing, central banks sought to stop the vicious circle of fire-sale declines in asset prices that were further reducing lending and business activity.

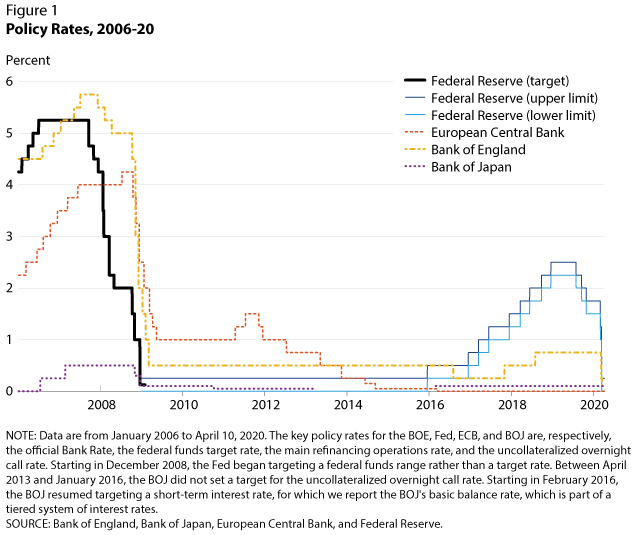

Policy Rate Cuts: Figure 1 shows that, in March 2020, the Fed's Federal Open Market Committee (FOMC) lowered the federal funds target range 150 basis points to 0 to 0.25 percent, while the Monetary Policy Committee (MPC) of the BOE lowered their bank rate from 0.75 percent to 0.10 percent. The ECB and the BOJ's main policy rates were already around zero and remained unchanged.

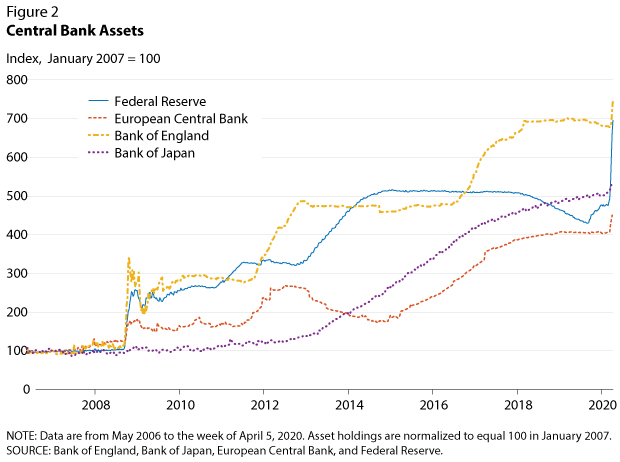

Asset Purchase Programs: Prior to these cuts, policy rates were not far above zero by historical standards. Figure 1 displays Fed, ECB, BOE, and BOJ policy rates from January 2006 through April 10, 2020. The rates prior to the 2007-09 crisis started out well above the levels in early 2020. With short-term policy rates constrained from below, central banks again turned to purchasing long-term bonds to reduce their yields and to lending programs to facilitate credit in specific sectors.1 Central bank balance sheets have consequently expanded at record paces (Figures 2 and 3).

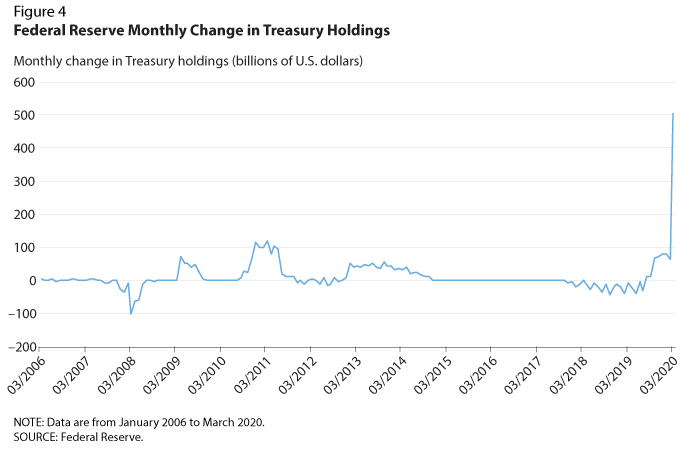

Since the global Financial Crisis of 2007-09, asset purchase programs have become a staple in the arsenal of central banks, especially with short-rates near their zero lower bound. Table 1 details these programs. Unlike the other central banks, the Fed has announced that it will conduct an open-ended purchase program, buying Treasuries and agency mortgage-backed securities. The Fed is buying assets unusually fast compared with past purchase episodes: Treasuries purchases peaked at $75 billion in late March before settling into the recent pace of $15 billion per day, which is much quicker than the peak pace of $120 billion per month during the previous financial crisis (Figure 4). These purchases have caused spikes in the Fed's balance sheet (see Figure 2) and changes in its assets (see Figure 3). Similarly, the BOE's MPC voted to purchase £200 billion ($250 billion) in bonds and the ECB and BOJ are augmenting their planned rates of purchases. On March 12, the ECB's Governing Council announced their response to COVID-19: a €120 ($131) billion envelope of purchases, followed on March 18 by the €750 ($820) billion Pandemic Emergency Purchase Programme (PEPP).2 The BOJ likewise increased its Japanese government bond (JGB) purchases to an ¥80 trillion ($743 billion) annual pace, increased commercial paper and corporate bond purchases, and doubled the pace of purchases of exchange-traded funds (ETFs) and Japanese real estate investment trusts (J-REITs).

Table 1: Asset Purchases and Lending Facilities

Federal Reserve

Asset Purchases: Open-ended purchases of Treasuries and agency mortgage-backed securities (MBS). The Fed Had previously announced intentions to increase Treasury and agency MBS holdings by at least $500 billion and $200 billion, respectively.

Lending Facilities

• Municipal Liquidity Facility (MLF)

Bank of England

Asset Purchases: £200 ($250) billion planned increase in bond holdings, mostly from purchases of U.K. government bonds, but also from nonfinancial corporate bonds.

Lending Facilities

| • Term Funding Scheme with Additional Incentives for Small and Medium Enterprises (TFSME) |

• Contingent Term Repo Facility (CTRF)

European Central Bank

Asset Purchases: €750 ($820) billion of public and private asset purchases under the Pandemic Emergency Purchase Programme (PEPP). €120 ($131) billion in temporary additional net asset purchases. The ECB expanded the range of eligible assets under the Corporate Sector Purchase Programme (CSPP).

Lending Facilities

• Targeted Longer-Term Refinancing Operations (TLTRO III)

Bank of Japan

Asset Purchases: ¥80 trillion ($743 billion) annual purchase pace of Japanese government bonds (JGBs). ¥12 trillion ($111 billion) and ¥180 billion ($2 billion) per year purchases of exchange-traded funds (ETFs) and Japanese real estate investment trusts (J-REITs); this is double the previous pace. ¥1 trillion ($9 billion) increases each of purchases of commercial paper (CP) and corporate bonds.

Lending Facilities

• Special Funds-Supplying Operations to Facilitate Corporate Financing Regarding the Novel Coronavirus

Lending Facilities: Asset purchases greatly increased bank reserves, but these safe, liquid assets are in high demand and unevenly distributed among banks; so short-term credit was still lacking in particular credit markets. Therefore, central banks have also introduced facilities to provide credit to specific financial markets. Table 1 lists the facilities the four central banks have recently established, along with links to their announcements that detail their purposes and operations.

In addition to restarting some facilities from the 2007-09 crisis, the Fed now intends to support lending to municipalities, corporations, and small and medium-sized enterprises (SMEs).3 These Fed lending facilities may jointly lend more than $2.3 trillion. The BOE has restarted a program to fund bank lending—the Term Funding Scheme (TFS)—but has added incentives for lending to SMEs. The TFS may fund more than £100 ($126) billion in lending, in addition to that provided by the BOE's new corporate and repo facilities. The ECB has also prioritized nonfinancial lending. It has expanded its long-term lending program (TLTRO III) to create incentives for banks to lend to businesses and households. The BOJ's facilities include one to facilitate corporate financing and another to ensure repo market stability.4

Other Actions: The four central banks also took other actions, such as relaxing bank capital requirements to foster lending. The ECB and BOE have requested that banks halt or limit dividends, buybacks, and bonuses. The Fed has expanded standing U.S. dollar liquidity swaps and created a repo facility to facilitate dollar-denominated lending by international monetary authorities.

Conclusion: Despite the very different nature of the underlying causes of the financial turmoil in 2007-09 and 2020, international central banks have responded to the resulting financial turmoil with similar tools. Indeed, the scope and speed of the international central bank policy response to COVID-19 has met or often exceeded that of the 2007-09 crisis. Central banks have cut rates, purchased assets, created lending programs, and modified financial regulations to support financial markets and minimize long-run economic damage.

Notes

1 Although some central banks have pushed their deposit rates below zero, there is limited scope to pursue negative rates.

2 The ECB had already been purchasing assets at a pace of €20 ($22) billion per month since November 2019.

3 The relevant Fed facilities are the Municipal Liquidity Facility (MLF), the Primary Market Corporate Credit Facility (PMCCF), and the dual facilities of the Main Street Lending Program (MSLP). Other facilities, such as the Secondary Market Corporate Credit Facility (SMCCF), the Paycheck Protection Program Liquidity Facility (PPPLF), the Money Market Mutual Fund Liquidity Facility (MMLF), and the Commercial Paper Funding Facility (CPFF), are also designed to support these entities.

4 The novel "Special Funds-Supplying Operations to Facilitate Corporate Financing Regarding the Novel Coronavirus" and the expanded Securities Lending Facility (SLF), respectively. Japan enacted programs to aid SMEs through other government institutions.

© 2020, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Find more analysis, data, and tools on our COVID-19 Research Resources page.

follow @stlouisfed

follow @stlouisfed