Indian Journal of Science and Technology

DOI: 10.17485/IJST/v13i35.1180

Year: 2020, Volume: 13, Issue: 35, Pages: 3695-3706

Original Article

Adebayo Felix Adekoya1, Isaac Kofi Nti1,2*

1Department of Computer Science and Informatics, University of Energy and Natural Resources, Sunyani, Ghana

2Department of Computer Science, Sunyani Technical University, Sunyani, Ghana.

Tel.: +233208736247

*Corresponding Author

Tel: +233208736247

Email: [email protected]

Received Date:18 July 2020, Accepted Date:21 August 2020, Published Date:05 October 2020

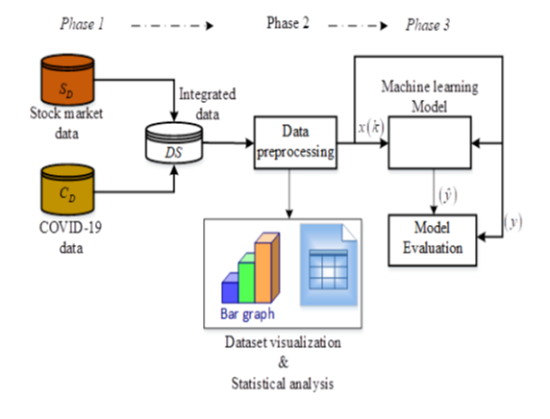

Background/Objectives: The Coronavirus disease in 2019 (COVID-19) was first seen in Wuhan (capital of Hubei, Chain), and has since spread throughout the world, resulting in the World Health Organisation (WHO) declaring the 2019–20 coronavirus a pandemic. Its ongoing spread has resulted in a standstill of the world’s economy, total lockdown in some counties, closedown of business and firms globally. As of 25th Mar 2020, 11:00 am GMT, a total of 491,280 cases were reported globally. The evolution of COVID-19 and its economic impact on the regional financial markets are highly uncertain, which makes it difficult for legislators to formulate a suitable macroeconomic strategy response.Methods: To ascertain the possible economic impact of COVID-19 globally, this study examines the effect of COVID-19 on major stocks indices across the globe. Using a random sampling technique, we selected thirty (30) world stock market indices in different countries infected with COVID-19 from 31st Dec 2019 to 25th Mar 2020. However, not like a high percentage of previous studies that focus on the regional stock market, we examine the information on daily reported COVID-19 cases and stock market fluctuation over thirty stock market indices that houses the stock prices of several countries around the globe. Also, we estimate the monetary loss within the period, project the future surge of this pandemic on the stock market and outline some portfolio allocation strategies to help the investor hedge against investment risk. Findings: The experimental results in this study show that even a controlled outbreak of the COVID-19 can significantly influence the world’s economy in both the short-term and longterm. Our obtained results of COVID-19 associated economic loss echoed in stock prices movements advise that the cost can escalate severely and quickly into global economic stress. Hence, we conclude by outlining some measure that might help investors hedge against such risk using portfolio allocation strategies.

Keywords: Coronavirus; COVID-19; Stock market; stocks price; pandemic; machine-learning; economic impact of COVID-19

© 2020 Adekoya & KofiNti.This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee).

Subscribe now for latest articles and news.