Immunotherapy is now a mainstay of cancer treatment. Here, we provide our latest update on the global immuno-oncology (IO) drug pipeline, including comparisons with analogous analyses conducted in the previous 3 years.

Growth in IO drug development

The number of IO drugs in the development pipeline in 2020 has grown to 4,720 — a 22% increase compared with 3,876 drugs in 2019 and a 233% increase with respect to 2017, when we first analysed this field (Fig. 1). After a moderate increase of 15% in 2019 (compared with 68% between 2018 and 2017), this 22% expansion suggests a resurgence of interest in IO in the past year, despite the impact of the COVID-19 pandemic.

Fig. 1 | Trends in the immuno-oncology (IO) drug development pipeline. The 4,720 IO agents in the current global clinical pipeline are compared with the pipelines from analogous analyses in previous years, based on the therapy type.

Examination of the growth within the six prominent types of immunotherapy reveals that hundreds of new cell therapies have been added each year, nearly quadrupling since 2017. The number of T cell-targeted immunomodulators (such as inhibitors of the PD1–PDL1 interaction), other immunomodulators and oncolytic viruses have also continued to increase compared with previous analyses. In 2019, there was a slight decrease in the number of cancer vaccines added to the pipeline compared to 2018; however, this decline has recovered in the past year, in part owing to new preclinical vaccines based on neoantigens and nanoparticle technology.

Expansion of targets

The upward trend in new target development for T cell immunomodulators, modulators of other immune cells and cell therapies that we observed in our previous updates continued in the past year. Looking at the top ten targets for active agents, the number of agents for most targets has continued to rise or stayed the same (Fig. 2). However, the number of agents targeting general tumour-associated antigens (TAAs) decreased, which may be owing to the decline in the number of vaccines. Indeed, when we analysed the top ten targets for which agents seem to have been deprioritized, the TAA group was the most prominent. Agents for other targets that have seen high development also seem to have been deprioritized in the past year, including CEA, IL-2R and IDO1, the latter presumably as a result of recent discouraging clinical data.

Fig. 2 | Top IO targets for active and deprioritized agents in the drug development pipeline from 2019 and 2020. We consider inactive agents to be those that are no longer being actively investigated owing to lack of efficacy or safety, or for business development reasons. TAA, tumour-associated antigen.

To further explore the immunomodulator pipeline, we analysed agents according to targeted cell types. The number of agents targeting different cell types (B cells, natural killer (NK) cells, or tumour-infiltrating lymphocytes) has increased year-to-year from 2018 to 2020 even more so than T cell-directed agents (Supplementary Figure 1).

Increase in the number of IO trials

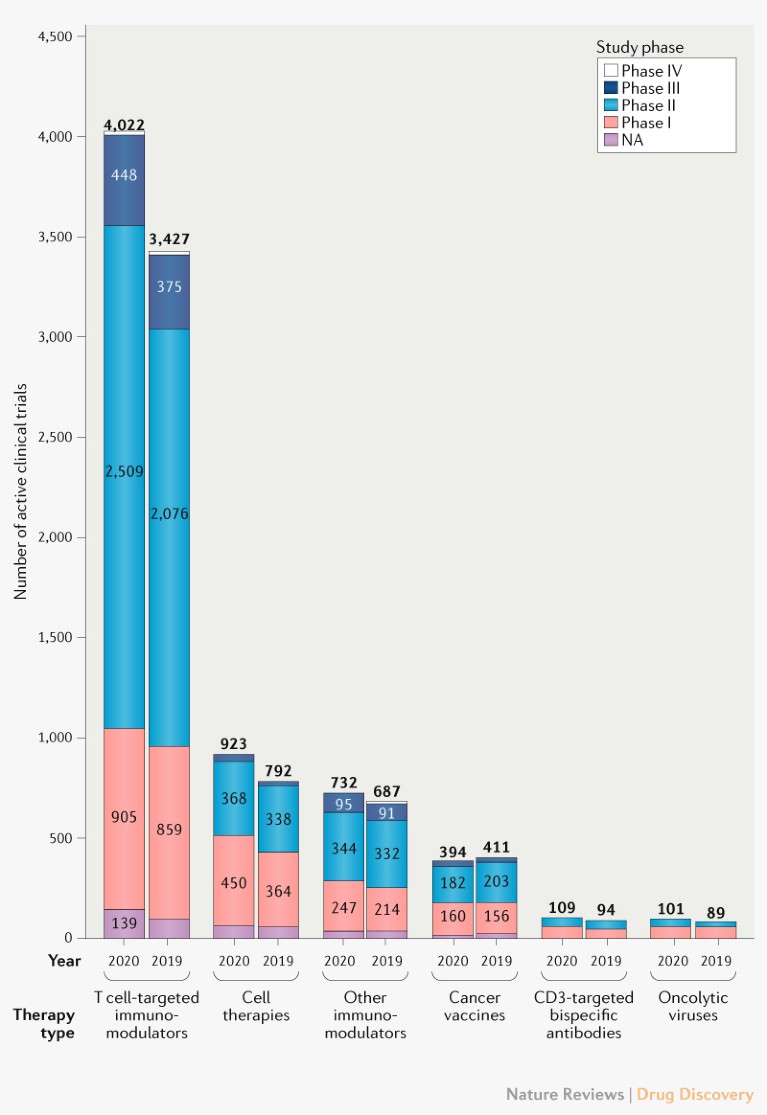

In our analysis of the ClinicalTrials.gov database, we identified 6,281 active clinical trials that are testing IO agents, which represents a 14% growth compared with 2019. The number of clinical trials assessing all immunotherapies grew except for those involving cancer vaccines, which showed a modest 4% decrease (Fig. 3). This may be related to the 2% decrease in cancer vaccine development last year (Fig. 1). However, there may be a future resurgence in cancer vaccine trials as the current preclinical vaccines progress.

Fig. 3 | Trends in clinical trials for IO agents. Landscape of the 6,281 active IO trials in 2020 classified by therapy type and development phase compared with 2019. NA, not applicable.

To better understand the growth in IO trials, we examined the monthly distribution of trials in the past 5 years. We found that, indeed, there was a greater decrease in new trials at the end of 2019 compared with previous years. This observation aligns with previous downturns in the autumn and the start of the COVID-19 pandemic, which disrupted clinical trial operations. However, the upturn in the number of IO trials in the past few months suggests a robust recovery and/or a catch up with backlogged trials (Supplementary Figure 2). The growth could also be attributed to a difference between the planned start dates and the actual start dates, as clinical trial information can be slow to update on public databases, a phenomenon observed between June and July of 2019 around the previous data cut-off.

Conclusion

The IO field continues to grow, with more drugs and trials for almost all IO drug classes compared with previous years. More IO agents are being added to the pipeline even as the competition grows for validated targets such as PD1 and CD19. Increasingly, the field is exploring immune cells beyond T cells. As our analysis captures the height of the COVID-19 pandemic in April 2020, it indicates that the disruption to the growth of the field has been temporary, with signs of recovery in clinical trial activity now apparent.