Abstract

In today’s increasingly specialized and fragmented sectoral chain, as well as increasingly close economic connections between regions, regional economic fluctuations caused by natural or human factors can be transmitted through the interregional economic network to external regions, causing losses. The assessment of external losses is the foundation for fully understanding the impact of emergencies and taking effective response measures. On the basis of the MRIO model, this paper constructs a model of the impact of the COVID-19 lockdown in Shanghai on the national economy and investigates the impact of artificial controls on the economies of various regions and sectors in China after the outbreak of the COVID-19 pandemic. The results indicate that the external losses caused by regional emergencies are much greater than the local losses. Second, the sectors with the greatest GDP losses caused by Shanghai’s lockdown are wholesale and retail, whereas the sectors with the greatest decline are metal product manufacturing, machinery and equipment maintenance services. Finally, the impact of Shanghai’s lockdown on other regions is not significantly related to their economic size or geographical location.

Similar content being viewed by others

Introduction

In current economic activities, the stages and specialization of production are conducted in a fragmented manner across regions (Makower 1969). Sectoral stages distributed in different regions are interconnected through modern information technology and transportation, forming a complete industrial chain. In routine activities, this industrial chain is efficient and economical, but it is also exposed to risks (Kancs 2024). When regional emergencies occur, the impact on local stages of the industrial chain will spread to the industrial sectoral chain through upstream and downstream input‒output relationships, resulting in a broader range of losses. Therefore, when responding to and dealing with regional emergencies, the risks they bring about in the sector chain, especially the risks of spillover, should be taken into account. On the one hand, extreme weather caused by climate change is increasingly becoming the norm. Natural disasters, such as epidemics, are abrupt and challenging to defend against (Islam and Wang 2024). On the other hand, with the promotion of the construction of a domestic unified market and the implementation of regional development strategies such as the Beijing‒Tianjin‒Hebei Cooperative Development and the Yangtze River Economic Belt Development, China’s interregional economic ties are being strengthened and deepened. In the past few decades, with the rapid development of the economy of China, the global economic center has tended to shift eastward (Balsa-Barreiro et al. 2019). This increases the possibility of global impacts caused by economic fluctuations in certain regions of China, as well as potential repercussions (Ma and Zhu 2024). Additionally, with the development and extension of the international supply chain and the evolution of global natural phenomena and international political circumstances, the risk of regional emergencies outside China being transmitted to China through the international supply chain persists. In this context, when responding to regional emergencies within China, the global economic impacts should be taken into account during the selection of policy measures. When emergencies occur outside of China, the potential economic ripple effects within the country should also be foreseen. This necessitates a quantitative assessment of the repercussions of spillovers from regional economic fluctuations.

Shanghai is China’s economic center, shipping and trade center, financial center, and science & technology innovation center. It is also a central city in the Yangtze River Delta and the Yangtze River Economic Belt and plays a crucial role in China’s economic network. In 2022, affected by COVID-19, Shanghai announced the implementation of a regional lockdown from April 1, 2022, to June 1, 2022, lasting for a period of two months. During this period, although the local government in Shanghai made efforts to implement various measures to sustain residents’ access to essential supplies and maintain business activities, many employees were inevitably affected by the lockdown. According to data released by the Shanghai Municipal Bureau of Statistics, the gross output of industries above the designated size in Shanghai decreased by 61.5% and 28.3% year-on-year in April and May 2022, respectively.

Therefore, this paper chooses the lockdown event in Shanghai in April and May 2022 as a typical case to study the overall impact of regional economic fluctuations. According to the characteristics of a “regional lockdown,” this paper chooses the input‒output (IO) technique to study this problem. On the basis of the multiregional input‒output (MRIO) technique, this paper constructs an input‒output model of localized production shocks to analyze localized production shocks, compiles an interprovincial input‒output table of China during the pandemic period via the RAS method, and utilizes monthly data during the lockdown period of Shanghai to study the national impact of Shanghai’s lockdown. The national impact of Shanghai’s lockdown is evaluated via monthly data from the period of Shanghai’s lockdown. Potential marginal contributions include exploring the input‒output relationship between regional production capacity and the value added by external sectors in theoretical modeling, compiling China’s interprovincial input‒output tables to reflect the economic input‒output relationship during the pandemic period in terms of technical tools, and empirically investigating the specific impacts of Shanghai’s lockdown at the interprovincial sectoral level. The research in this paper proposes ideas and methods for assessing the impact of regional economic fluctuations on the whole economy, which is valuable for responding to regional emergencies and implementing more efficient measures.

The remainder of the paper is organized as follows: Section 2 reviews and critiques the existing relevant studies; Section 3 derives and justifies the input‒output model of localized production shocks and describes the data sources; Section 4 presents the results and discusses them; and Section 5 presents the conclusions and implications of the study.

Literature review

Emergencies trigger cascading effects in the global sectoral chain, mainly manifested as supply chain interruptions, decreased production capacity, and obstructed trade, thereby increasing the instability and vulnerability of the global sectoral chain. A system with many interdependencies can be extremely vulnerable to malfunctions, even if it does not come from the most important nodes. Chaos theory, which is inherent to complex systems, explains that small variations may entail enormous changes in entire systems. Similarly, any potential malfunction can effortlessly cascade across the whole system and affect its functional behavior (Balsa-Barreiro et al. 2020; Obrien et al. 2015). If external shocks lead to the bankruptcy of a bank, the combination of leverage and shocks may trigger the failure of other banks that invest in the same assets. If the parameters of the system amplify shocks, this can generate a cascading failure that propagates through the system (Caccioli et al. 2012). Global events such as hurricanes along the Gulf of Mexico coast, earthquakes in Chile and Japan, and even heatwaves have highlighted interdependence, increasing the likelihood of cascading failures and amplifying the impact of large-scale and small-scale initial failures into catastrophic events (Ouyang 2014).

Major emergencies, such as infectious diseases, have a significant impact on economic and social development within a specific time and space. One notable example is the cholera incident in London in 1854, which resulted in long-term poverty for its residents (Ambrus et al. 2020). Another example is the “Asian flu” pandemic in 1958, the peak of which reduced the gross domestic product of the United States by approximately 15% (Henderson et al. 2009). Prager et al. (2017) reported that pandemic influenza not only poses a serious threat to the population in the United States but also impacts the macroeconomy through school closures and preventive absenteeism. The outbreak of SARS in China in 2003 had significant and far-reaching repercussions on the economy. Brainard et al. (2023) argued that the substantial means to limit the spread of SARS were to restrict the flow of people. Therefore, provinces with a significant proportion of Chinese and foreign populations, as well as economies that rely heavily on foreign labor, experienced more pronounced negative impacts, particularly in the tertiary industry. In particular, the entertainment, catering, transportation, and tourism sectors bore the brunt of the blow (Li et al. 2021). In addition to SARS, other major global epidemics, such as Ebola virus and influenza A (H1N1), have also had significant impacts on the economic system (World Bank 2014; Ichev and Marinč 2018; Novelli et al. 2018). In terms of the emergence of COVID-19, Chan (2022) conducted a systematic analysis of its impact on China’s macroeconomic operation via a DSGE model. The results indicated that COVID-19 had a short-term negative impact on the economy, which was manifested mainly by the rapid increase in consumption and investment demand. Zhang et al. (2021) evaluated the combined effects of demand-side and supply-side impacts on China’s economy. The results revealed that the combined supply‒demand impacts of the pandemic reduced GDP by approximately 6% in the short term and 7% in the long term.

As one of the major production bases in the global production system, China’s capacity loss caused by the pandemic has had serious repercussions on upstream and downstream economies through the global production network (Kazancoglu et al. 2023; Tian et al. 2022). For Hubei Province, the economic impact of the pandemic on the province’s economy has been more severe than its impact on the economy outside the province (Wen et al. 2022). In addition, widespread outbreaks of pandemic diseases have negative impacts on various sectors, such as the transportation sector (Sung et al. 2023), shipping and port sector (Zhou et al. 2022), hospitality sector (Santos et al. 2023), and aquaculture sector (Mirto et al. 2022). The financial sector amplifies the risk spillover from the midstream to the upstream and downstream. Risks are transmitted and amplified from downstream to midstream to upstream (Li et al. 2023). In terms of crisis response, local government administrations should strengthen their awareness of territorial governance responsibility and improve their ability in emergency management (Janssen and Voort 2020). An effective approach is to strengthen budget performance management, improve local financial and tax systems, and implement expenditure responsibility allocation plans through proactive fiscal policies (Degryse and Huylebroek 2023). In the postpandemic era, the government should adopt diverse strategies, such as innovation-driven high-quality industrialization, new urbanization, the ‘dual circulation’ new development strategy, and macroeconomic control strategies that coordinate risk prevention with stable growth (Bi 2023).

There are many quantitative methods for researching the economic impact of major emergencies, but in terms of assessing the specific extent of the economic impact of the epidemic, the input‒output (I-O) economic model and computable general equilibrium (CGE) have played prominent roles in disaster impact analysis and resilience assessment (Galbusera and Giannopoulos, 2018). Wu et al. (2023) utilized the multiregional input–output model (MRIO) to simulate the economic repercussions of Japan’s release of nuclear wastewater into the Pacific Ocean. They highlighted that such actions by Japan would result in harm to marine fisheries, leading to significant repercussions for fisheries and other sectors in Japan, as well as in other countries and regions globally. Japan’s real estate sector is highly vulnerable to seismic activity, with the dynamic inoperability input‒output model (DIIM) estimating that $27.4 billion was lost during the earthquake (Alam and Ali 2023). In the context of the COVID-19 pandemic, Han (2022) used the newly released I-O table and reported that the pandemic accelerated the structural transformation process of China’s economy. Globally, after the 2011 earthquake in Japan, some scholars provided an I-O method for estimating the global economic impact of supply chain disruptions while combining a hybrid multiregional I-O model to quantify the economic impact of state and sector disruptions (Arto et al., 2015; Tokui et al., 2016).

Against the background of the COVID-19 pandemic, Santos (2020) used an input‒output analysis to model the impact of pandemic mitigation and suppression measures on the workforce and reported that these measures can potentially reduce and delay the number of daily infections caused by the pandemic. Jia et al. (2021) used a multisector, multihousehold CGE model to consider six different scenarios, simulating and evaluating the overall impacts of the pandemic and oil prices on energy, the economy, and the environment. They found that the decline in factor inputs is the main cause of the economic recession. In conclusion, the multiregional input‒output (MRIO) model can be used to describe the economic flows between multiple regions and various economic sectors and can overcome the estimation bias caused by the assumption of technical homogeneity in the single-region models. On the basis of an MRIO model, this study overcomes the limitations of existing theoretical models and constructs an input‒output model of localized production shocks. We describe the sectoral relevance and economic relationships between different regions and sectors and examine the impact of region-wide silence measures in Shanghai on the economies of various regions and sectors nationwide after the outbreak of the epidemic.

Theoretical framework

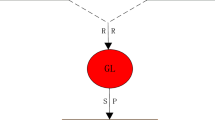

Regional economic fluctuations in Shanghai further spread to other regions of China through a national production network composed of sectoral chains. This diffusion occurs in two directions: first, it spreads upstream to external sectors that rely on Shanghai’s demand; and second, it spreads downstream to external sectors that depend on Shanghai’s investment or input. The sectors in Shanghai that are affected by regional lockdown, especially those that play crucial roles in the national sectoral and supply chains, such as computer electronics, communication, automobiles and parts, pharmaceuticals, and equipment manufacturing, have had widespread impacts on the national economy. Compared with the clear statistical data in Shanghai, it is difficult to directly estimate the impact on the national economy from statistical data. The theoretical framework of this study is shown in Fig. 1.

After implementing artificial control measures of lockdown against the pandemic, economic activity in Shanghai was suppressed and had the following characteristics:

-

(1)

Homogeneity. Regulatory measures mainly target social activities rather than specific enterprises; therefore, they are universal. For different enterprises classified in the same sector, the level of suppression is identical. Therefore, different enterprises in the same sector, both upstream and downstream, are also subjected to the same indirect suppression. There is no heterogeneity in the upstream and downstream impacts caused by product heterogeneity within the sector. This is consistent with the assumption of sectoral homogeneity in the input‒output model (Arto et al. 2015).

-

(2)

Short-term. Owing to the sudden and short-term nature of regional epidemics and the accompanying lockdowns, economic systems in multiple regions are unable to adjust and promptly expand production capacity during the silent period. Intermediate demand and final consumption can be sustained in the short term by depleting inventory.

-

(3)

Regionality. The lockdown was limited to the jurisdiction of Shanghai and did not impose administrative constraints on areas outside of Shanghai. Therefore, it is believed that it had no direct effect on the economies of other cities. Moreover, despite implementing regional lockdown measures, the government established a whitelist of essential enterprises to maintain supply chain operations.

-

(4)

Supply-side. Government regulations directly impact the business activities of regional enterprise entities. Accordingly, local consumption suffers indirect effects, analogous to economic activities in other regions. For example, the decrease in consumer demand for goods is attributed to restrictions on retail business activities rather than a decline in consumer willingness to consume. Therefore, this study explores the changes in the production capacity of various sectors within the Shanghai region. By combining the above characteristics with the theoretical assumption of input‒output, a model of the impact of regional lockdown on the national economy can be constructed on the basis of MRIO technology.

Methodology and data

Research area

Shanghai is located in eastern China, on the west coast of the Pacific Ocean, and on the eastern edge of the Asian continent. As of 2020, Shanghai has a permanent population of 24.8836 million, belonging to the Yangtze River Delta alluvial plain. It is located between 120°52′E and 122°12′E and between 30°40′N and 31°53′N. Although Shanghai accounts for only 0.06% of the country’s land area, as the largest city in China’s economic output, its GDP and per capita GDP rank among the highest in the country. In 2023, its annual GDP reached 4.72 trillion yuan (65.4923 billion USD), ranking first among cities in the country. Its strong industrial foundation, advanced technological innovation capabilities, and abundant financial resources have enabled Shanghai to occupy a pivotal position in the Chinese and global economic stages. Shanghai has a diverse sectoral structure in finance, trade, logistics, tourism, and other fields. The largest financial market in China is located here, with the Shanghai Stock Exchange, Shanghai Futures Exchange, and Shanghai Financial Futures Exchange. The financial sector in Shanghai not only has a considerable influence on China’s domestic economy but also occupies an important position in the international financial market. In 2023, Shanghai’s economic output was in the first tier, along with several cities, such as New York, Tokyo, Los Angeles, and London. Shanghai will play a leading role in the integration of the Yangtze River Delta, driving the agglomeration of industries in surrounding cities and narrowing income gaps, creating a world-class bay area economy and urban agglomeration. According to Shanghai’s 14th Five Year Plan development goals, the economic scale of Shanghai is expected to approach 800 billion USD, and the per capita GDP is expected to exceed 30000 USD by 2025.

Multiregional input‒output (MRIO)

The input‒output (I-O) table is a tessellated balance sheet based on the vertical and horizontal intersection of the sources of inputs in the production of products in each sector of the national economy and the destinations of the products to be used. As an intuitive “model” that simulates the actual economic system, input‒output analysis primarily reflects the quantitative relationships of interdependence and mutual constraints among economic technologies in different sectors of society. It encompasses the processes of production, distribution, consumption, and the use of products, as well as the formation of product value (Leontief 1986). However, the basic input‒output method is limited to studying the equilibrium relationship between inputs and outputs within a given region. To ensure the reliability and validity of the measurement methodology (Isard 1951), scholars have developed the multiregional input‒output (MRIO) model. It provides a reliable measurement method for studying the relationships among economic activities, the direction of commodity and factor flows, and the interdependence among regions (Li et al. 2022). The basic formula is shown in Eq. (1).

Introducing the unit matrix, Eq. (1) is decomposed into

where X denotes the total output matrix and A denotes the direct consumption factor matrix. The final demand matrix, denoted as \({(I-A)}^{-1}Y\), is the Leontief inverse matrix.

Row arrange series (RAS)

The row arrange series (RAS) method proposed by Richard Stone (1962) is the most commonly used method for predicting and updating I‒O tables. Owing to its low data requirements and high efficiency in updating and obtaining time series of constant-price IO tables, the RAS method has been widely applied. The RAS method operates on the principle of using the intermediate use of the target year as a row vector and the sum of the intermediate inputs of the target year as a column vector. It adjusts the coefficients of the row and column vectors on the basis of the input structure of the base year via the bilateral scaling algorithm. This ensures that the intermediate input matrix satisfies both the row and column constraints. In other words, it allows for the calculation of the intermediate inputs given the final use and total outputs of the target year (Liu et al. 2022). The formula is as follows:

where \({A}_{1}\) denotes the direct consumption coefficient of the target year’s MRIO table. Z1 and X1 denote the intermediate input matrix and total output of the target year, respectively. r denotes the row iteration coefficient (\({\rm{r}}_{\rm{i}}= \Sigma^{\rm{n}}_{{\rm{i}}=1} {\rm{Z}}^{r}_{\rm{ij}}\)). \(s\) denotes the column iteration coefficient (\({\rm{S}}_{\rm{j}}= \Sigma^{\rm{n}}_{{\rm{i}}=1} {\rm{Z}}^{\text{r}}_{\rm{ij}}\)). The subscript n denotes the number of row and column multipliers. ^ denotes the diagonalization of the vectors.

Input‒output model of local production impact

According to the general theory of input‒output (Eq. 2), there are commonly used forms of the model, i.e., the case where final consumption is exogenous and total output is endogenous:

Mathematically equivalent to

In line with the previous reasoning, we attempt to establish the form of the input‒output model in which the total output is constrained. First, the matrix in Eq. (5) is chunked, i.e.,

In Eq. (6), it is assumed that 2 refers to regions or sectors where total output is constrained, whereas 1 refers to regions where total output is not directly affected. Then, Y1 and X2 are exogenous, whereas Y2 and X1 are endogenous. This leads to further reasoning about the input‒output model in which capacity in individual sectors is constrained. Moving the endogenous and exogenous variables in Eq. (6) to the left and right sides of the equal sign gives the following:

Equation (7) can then be written as follows:

By the property of the inverse of triangular matrices, we can determine the following:

When

Thus, Eq. (7) can be changed to

From Eq. (7), we can obtain

If the total output of region 2, X2, is changed to αX2 by the external influence, then from Eq. (6), \({\beta }_{1}\) is the change in total output of region 1, and \({\beta }_{2}\) is the change in final consumption in region 2, i.e.,

From Eq. (9), the total output of region 1 at this time is

The magnitude of change in X1 is

Equation (11) shows that the variation in X1 can be divided into two stages. The first stage is \({A}_{12}(\alpha -I){X}_{2}\), the direct change in region 1 due to the change in region 2.

The diagonal matrix of the value added can be defined as follows:

Then, the value added column vector is

The column vector of value added can be written as follows when gross output changes:

The elemental sum of \(\gamma V\) in Eq. (14) is the GNP of regions 1 and 2 when the capacity of region 2 is constrained:

For the estimation of the monthly production decline coefficient, this paper assumes that if it is not affected by the regional lockdown, then Shanghai’s economic statistics in April and May 2022 should continue the growth rate of the first quarter of 2022 on the basis of the monthly structure of 2021. Therefore, this paper estimates the growth rate of Shanghai’s sectors in the first quarter of 2022, DRQ1(2022), on the basis of the monthly indicator data Econ M (2021) (according to the sectoral data published by the Bureau of Statistics). The data may include different indicators such as the operating income, and this paper assumes that the decline in these indicators is consistent with the decline in total output while also assuming that the first quarter growth rate of these indicators in 2022 were not affected by the pandemic. To reflect the differences among sectors, this paper substitutes the average growth rate of Shanghai in the first quarter with the sectoral growth rates (by vector of growth rates) of Shanghai when calculating the benchmark scenario. To eliminate the influence of seasonal factors on the decline coefficients of various sectors in Shanghai from April to May, this paper adopts the year-on-year growth rate of the first quarter of 2022 to replace the quarter-on-quarter growth rate. This is then compared with the actual data Econ M (2021) for each industry in April and May 2022 published by the Shanghai Statistics Bureau, which gives the coefficients of production decline for each industry in Shanghai in April and May:

Similarly, on the basis of the 2022 GDP growth rate target GR2022 proposed in the Shanghai Municipal People’s Government’s 2021 Work Report, the full-year GDP of Shanghai in the absence of the April and May regional quiet management was estimated as GDP 2021 and GR 2022 and compared to the actual GDP2022 of Shanghai to obtain the full-year 2022 decline factor of Shanghai’s industry production:

The corresponding change in GDP can be calculated by substituting α1 and α2 into Eq. (16).

Data sources and processing

The intermediate input matrix, total output, and total consumption data, as well as the coefficient of production decline, are from the input‒output table. Among them, the input‒output table is a Chinese interprovincial input‒output table that we compiled ourselves via the RAS method. It is based on the 2017 Chinese interprovincial input‒output table (Li et al. 2021) and incorporates data collected from the 2021 Statistical Yearbook of each Chinese province. The reasons and benefits of adopting this method are as follows: China’s input‒output tables are typically updated every five years. There is currently no widely recognized interprovincial input‒output table compiled after the pandemic. China’s economy has been significantly impacted and changed by the pandemic, which suggests that the interprovincial input‒output relationship after the pandemic will probably differ from that before the pandemic. In this paper, we use postpandemic data. On the basis of the 2017 interprovincial input‒output table of China and the RAS method, we incorporate the impact of the pandemic on the input‒output relationships of the Chinese economy into a new table, which is more reasonable than obtaining results and conclusions via prepandemic tables (Chen 2011). To estimate the monthly production decline coefficient, this paper assumes that if not affected by regional lockdowns, the economic statistics for April and May 2022 in Shanghai should continue the growth rate of the first quarter of 2022, on the basis of the monthly structure of 2021. The data used in this study are obtained from the monthly data provided by the Shanghai Bureau of Statistics.

Results and discussion

The impact of the lockdown on various sectors in Shanghai

This study calculates the production decline of all sectors in Shanghai that were affected by the lockdown in April, May, and throughout the entire year of 2022 via Eqs. (16) and (17). As shown in Fig. 2 (The full names and abbreviations of the 42 departments can be found in the supplementary information), during the implementation of the regional lockdown in April and May 2022, the gross added value of various sectors in Shanghai decreased by 34.1% (10.72 billion USD), resulting in a 2.7% decrease in the annual GDP. Regional lockdown has a certain negative impact on the economy. This finding is consistent with the findings of Yu et al. (2020) and Arto et al. (2015). From a sector perspective, the largest decline was in the nonmetallic mineral manufacturing industry, which experienced a decline of 71.9% during the specified period and an annual decline of 11.2%. Other sectors that experienced significant declines include the manufacture of metal products (59.7%), residential services, repairs, and other services (58.1%), wood processing products and furniture (57.3%), and communication equipment, computers, and other electronic equipment (51.2%). All of these sectors experienced a decline of more than 50% during the quiet periods. The transport equipment manufacturing industry suffered the greatest loss in added value, with a production value decrease of 1.69 billion USD during the quiet period. Other sectors that experienced a significant decline in added value include real estate (1.17 billion USD), wholesale and retail trade (1.11 billion USD), communication equipment, computers, and other electronic devices (0.86 billion USD), and information transmission, software, and information technology services (0.85 billion USD).

Notably, during the lockdown period, the oil and gas extraction sectors, as well as the oil, coking, and nuclear fuel processing sectors in Shanghai, increased by 38.7% and 17.1%, respectively, year-on-year. Based on previous years’ data, the oil and gas extraction industry in Shanghai has experienced rapid growth in recent years because of the development of oil and gas fields in the East China Sea. In April and May 2021, there were year-on-year increases of 29.2% and 32.5%, respectively. This trend continued in 2022. Moreover, Shanghai’s oil and gas exploration has focused primarily on offshore areas, which have isolated environments and are less affected by the lockdown. The year-on-year growth in the petroleum, coking, and nuclear fuel sectors is due mainly to the significant decline in the same period in 2021—a decline by 12.8% compared to that in 2020. Considering the revised statistical data, the decrease in April and May 2021 may be even greater. Therefore, the growth of the petroleum, coking, and nuclear fuel sectors in Shanghai is only the restoration of existing production capacity in key sectors while mitigating adverse impacts. In addition, the GDP of the financial sector increased by 0.24 billion USD compared with that of the previous month. Owing to the early adoption and extensive implementation of digital transformation in Shanghai’s financial industry, the majority of business transactions have successfully transitioned to online and digital platforms. Moreover, financial institutions have their own business continuity operation plans to ensure that their core business is not interrupted during an emergency situation. Therefore, although the branches and business sectors of Shanghai’s financial institutions have been completely closed, their core business has not been interrupted. Shanghai financial institutions have integrated offline and online operations to ensure the smooth functioning of financial businesses through various methods, including onsite offices, remote offices, multicenter support, and AB job backup.

The impact of Shanghai’s lockdown on various sectors in other regions

This paper calculates the impact of the Shanghai lockdown in April and May 2022 on the national economy during that period and for the entire year of 2022. As shown in Fig. 3, the largest value added losses by sector in the regions outside of Shanghai were, in order, as follows: transportation, storage, and post (3.73 billion USD); renting and business activities (2.97 billion USD); finance (2.42 billion USD); manufacture of computers, communication, and other electronic equipment (2.31 billion USD); and real estate (1.71 billion USD) (see Fig. 3 for details). These six sectors alone accounted for 50.6% of the total losses outside of Shanghai. The regional lockdown not only caused economic losses within the region but also had serious effects on the entire production and supply chain, affecting upstream and downstream economies. This conclusion is similar to the findings of Tian et al. (2022). In descending order, the largest decreases outside of Shanghai were in the manufacturing of metal products, repair services for metal products, machinery, and equipment (12.78% for the current period, 1.77% for the year), transportation, warehousing, and postal services (5.59% for the current period, 0.59% for the year), manufacturing of transport equipment (5.36% for the current period, 0.83% for the year), manufacturing of computers, communication, and other electronic equipment (4.81% for the current period, 0.72% for the year), and general equipment (4.4% for the current period, 0.67% for the year), and metal products (3.83% for the current period, 0.58% for the year).

When the situation in Shanghai is compared with that in other regions, the sectors affected by Shanghai’s lockdown show both relationships and differences. First, the wholesale and retail trade, transportation, warehousing, and postal sectors all experienced significant losses. This aligns with the widely accepted understanding of the impact of epidemics and lockdowns on logistics, transportation, and trade. Second, communication equipment, computers, and other electronic devices generally experienced substantial losses, which could be attributed to intricate vertical regional specialization. Finally, businesses in high-end service sectors differed. The high-end service industry in Shanghai has not suffered much, except for the real estate sector. The financial sector has even maintained growth. However, in other provinces, the renting and business activities, financial, and real estate sectors suffered significant losses.

The most influenced sectors in Shanghai and the other regions differ. Some traditional manufacturing sectors and residential service sectors in Shanghai experienced significant declines due to this impact. In areas outside of Shanghai, the manufacturing of transport equipment, general equipment, and metal products sectors experienced the greatest declines due to repercussions. These results indicate that, first, as China’s shipping and trade center, the lockdown in Shanghai significantly affected transportation and trade in other regions of the country. Second, Shanghai is one of the key areas in China’s electronic information industry and plays a crucial role in the supply chain. Third, Shanghai’s position as China’s international economic and financial center, as well as its financial influence over other regions of the country, is reflected in its prosperous finance sector. Fourth, the difference between the direct and indirect impacts of the lockdown may have resulted in structural disparities in the effects on sectors in Shanghai and other regions.

The economic impact of Shanghai’s lockdown on other regions of China

Figure 4 shows the economic changes in April and May 2022 in provinces outside of Shanghai that were affected by Shanghai’s lockdown. They can be roughly categorized into four classes: 0–1%, 1–2%, 2–3%, and 3% or more, depending on the magnitude of the decline due to the impact. These levels are referred to in this paper as Level 1, Level 2, Level 3, and Level 4. The regions affected at Level 1 include Qinghai, Ningxia, Yunnan, Fujian, Hubei, Sichuan, Shandong, and Jiangsu. Among them, Jiangsu and Shandong consistently rank among the top 3 in China in terms of total economic output. Both provinces are located in the coastal area of East China, in close proximity to Shanghai, and benefit from convenient transportation stages. According to the general rule, they should have a strong economic connection with Shanghai. The sectoral data indicate that Shanghai remained silent during the period. The largest loss was incurred by Jiangsu, amounting to 0.31 billion USD, reflecting a decline of 1.4%. The largest decline was in the renting and business activities sector, with a decrease of 5.3% and a decline in value added of 110.34 million USD. Jiangsu’s major economic sectors, including real estate, construction, finance, computer manufacturing, communication, and other electronic equipment, as well as the chemical industry, were minimally affected by Shanghai’s lockdown. Most of the manufacturing and service sectors experienced an impact of less than 1%. Zhou and Lei (2020) and Zhuang and Zhao (2022) noted that in the development of the Yangtze River Delta region, the economic linkage between Shanghai and Zhejiang is significantly greater than that between Shanghai and Jiangsu. Zhang and Zhang (2023), as well as other studies on the economic resilience of cities, reported that the economic resilience linkages between the cities of Shanghai and Zhejiang present close intraplate characteristics, whereas the cities of Jiangsu are outside of the plate. This study shows that despite Jiangsu’s position as an important part of the Yangtze River Delta Economic Circle and its geopolitical proximity to Shanghai, it is minimally affected by Shanghai’s influence on the national production network upstream.

Another comparable situation is that of Shandong Province, which is similar in size but slightly more remote. Shandong, the largest northern economic province, experienced a decline of 0.42% in GDP during the lockdown period in Shanghai. This decline was one of the smallest in the country, even lower than that of most western border provinces, as well as all northeastern and northern provinces in China. This reflects the low level of economic ties between Shandong and Shanghai. In terms of sectors that were affected by Shanghai’s lockdown, the largest decline in Shandong was observed in the manufacturing of metal products, repair services for metal products, and the machinery and equipment sector. This sector experienced a 12.5% decrease during the period, resulting in a loss of 69 million USD in value added. Almost all other sectors experienced declines of less than 2%, with the median sectoral decline being only 0.26%. The greatest value added losses were associated with petroleum, coking products, and the processing of petroleum, coking, and nuclear fuel (130 million USD), as well as wholesale and retail trade (120 million USD).

Seventeen provinces, including Guangdong, Henan, Hunan, Hebei, Anhui, Beijing, Shaanxi, Chongqing, Guangxi, Liaoning, Inner Mongolia, Guizhou, Heilongjiang, Xinjiang, Gansu, and Tibet, were affected at Level 2, making it the most common. Guangdong is China’s largest economic province with the highest GDP loss due to Shanghai’s lockdown. It experienced a loss of 4.98 billion USD, representing a decrease of 1.86%. This places Guangdong in the 7th position among all provinces. The sector in Guangdong that suffered the largest drop was the repair service for the manufacturing of metal products, machinery, and equipment, with a decrease of 10.37%. Other sectors with large decreases were the manufacturing of transport equipment (6.9%), the manufacturing of metal products (5.9%), the manufacturing of computers, communication, and other electronic equipment (4.3%), and the papermaking, printing, stationery, and sporting goods manufacturing (3.9%) sectors. In addition, the main economic sectors in Guangdong Province, such as the wholesale and retail sector, incurred a loss of 7.84 billion USD (a decrease of 3.6%). The financial sector incurred a loss of 5.65 billion USD (a decrease of 1.7%), the real estate sector incurred a loss of 3.42 billion USD (a decrease of 1.3%), and the transportation equipment manufacturing sector incurred a loss of 3.12 billion USD (a decrease of 6.9%). This demonstrates the influence of Shanghai’s economy on Guangdong’s economy.

In terms of intersectoral intermediate linkages (intermediate inputs and intermediate demand), the manufacturing of computers, communication, and other electronic equipment in Guangdong and Shanghai has significant mutual intermediate connections, resulting in bidirectional impact. Shanghai’s wholesale and retail trade, as well as the chemical industry, also provide significant intermediate inputs to Guangdong’s manufacturing of transport equipment, computers, communication, and other electronic equipment. The declining capacity of these sectors in Shanghai limits the production of these goods in Guangdong. Guangdong’s wholesale and retail trade had significant intermediate inputs into Shanghai’s manufacturing of the transport equipment sector while simultaneously having a substantial intermediate demand for Shanghai’s wholesale and retail trade. There are fewer direct connections between the finance and real estate sectors between the two regions, and the impact is from indirect effects. The manufacturing sectors of transport equipment in the two regions are closely interconnected. The direct input coefficient from Shanghai to Guangdong is 0.11, whereas the direct input coefficient from Guangdong to Shanghai is 0.177. Moreover, there was a 37% decline in the manufacturing of transport equipment sector in Shanghai, which resulted in a corresponding decline in the transportation sector in Guangdong. To summarize, although Guangdong suffered significant economic losses due to the impact of Shanghai’s lockdown, these losses can be attributed primarily to the large volume of the various sectors in Guangdong. The actual rate of decline is not remarkable compared with that of other provinces.

Several other significant provinces were affected at Level 2. In Shanxi, the coal mining sector experienced the greatest value added losses, amounting to 136.72 million USD by 2.6%, accounting for 21% of the total. In Liaoning, the processing of petroleum, coking, and nuclear fuel had the largest value added losses, totaling 180 million USD by 3.9%, which accounted for 29% of the total. This shows that Shanghai’s products and services have a significant influence on the key sectors of Shanxi and Liaoning in the national production network. An analysis of the direct demand coefficients of the input‒output table clearly reveals that the direct intermediate input coefficients of Shanghai’s sectors to Liaoning’s processing of petroleum, coking, and nuclear fuel sectors are small. However, the direct intermediate demand coefficients of the transportation, warehousing, postal, and renting and business activities sectors to Liaoning’s processing of petroleum, coking, and nuclear fuel sectors are large. The decline in total output of the transportation and warehousing sector in Shanghai by approximately 40% is evident in the decline in intermediate demand for the petrochemical sector in Liaoning. Shanxi’s situation differs. The direct intermediate demand coefficients and direct intermediate input coefficients of Shanghai’s sectors and Shanxi’s coal mining sector are small. Therefore, the actual repercussions may come from an indirect pass-through of the national production network. In other words, the Shanghai lockdown affected sectors in other provinces, which in turn further affected the coal mining sector in Shanxi.

The provinces affected at Level 3 include Jiangxi, Tianjin, Jilin, and Hainan. The most affected region was Jiangxi, which experienced a loss of 1.26 billion USD or 2.45%. The sectors that experienced significant losses included transport, storage, and postal services (240 million USD, 12.3%), real estate (16 million USD, 4.6%), wholesale and retail trade (131.19 million USD, 2.9%), and finance (125.67 million USD, 3.6%). In addition, Jiangxi’s agriculture suffered a loss of 109.10 million USD or 2.6%. Tianjin was the most affected municipality, experiencing a value added loss of 1.00 billion USD or 2.3%. The sectors with the greatest losses included renting and business activities (190 million USD, 7.3%), finance (0.13 billion USD, 3%), and transport, storage, and post (0.12 billion USD, 7.5%). In addition, the nonmetallic mineral products sector in Tianjin experienced the largest decline of 10.4%, resulting in a loss of 29.00 million USD in value added. Tianjin also suffered the largest loss of 64.91 million USD in the oil and gas extraction sector, surpassing any other province with significant oil and gas production capacity. Jilin lost 0.61 billion USD in value added, with the transportation equipment sector accounting for 0.18 billion USD (a decrease of 4.6%), representing 30% of the total loss. This demonstrates the strong connection between Jilin and Shanghai in the transportation equipment industry. The transportation, storage, and postal sectors in Jilin experienced the largest decrease (12% or 133.96 million USD).

The only province affected at Level 4 was Zhejiang. During the Shanghai lockdown, Zhejiang experienced a decline of 3.2% in gross value added, resulting in 3.97 billion USD in losses. The sectors in Zhejiang that experienced significant losses included renting and business activities (930 million USD), wholesale and retail trade (430 million USD), nonmetallic mineral products (430 million USD), communications equipment, computers, and other electronic equipment (310 million USD), and transportation, storage, and postal services (25 million USD). As shown in Fig. 4, eight sectors in Zhejiang had the largest losses in the same sector. These sectors included renting and business activities (930 million USD), manufacturing of nonmetallic mineral products (430 million USD), production and supply of electricity and heat (110 million USD), manufacturing of general purpose machinery (99 million USD), mining and processing of nonmetal and other ores (30 million USD), manufacturing of textiles (23 million USD), manufacturing of metal products, repair services for metal products, machinery, and equipment (17.95 million dollars), and instruments (55 million dollars). Sectors with major decreases included the manufacturing of nonmetallic mineral products (27.3%), the manufacturing of metal products and repair services for metal products, machinery, and equipment (24.5%), the mining and processing of nonmetal and other ores (24.4%), communications equipment, computers, and other electronic equipment (11.7%), and renting and business activities (10.6%). The sectors with major decreases in Zhejiang were relatively concentrated. Excluding the five sectors with the largest decreases, only transport, storage, and post (6.3%) exceeded 5%. These results reflect the strong economic ties between Zhejiang and Shanghai. In particular, the five sectors experiencing the largest decreases were significantly impacted by the upstream and downstream aspects of Shanghai’s economy.

Conclusions and policy implications

On the basis of the MRIO model, this paper constructs an evaluation model to assess the impact of the lockdown in Shanghai on the national economy and examines the effects of artificial control measures on the economies of regions and sectors outside of Shanghai in China following the outbreak of the COVID-19 epidemic. The main conclusions of this study are as follows: First, the lockdown of Shanghai during the pandemic in April and May 2022, which suppressed the spillover effects of Shanghai’s economy on the production network of other regions in China, resulted in significant economic losses. Second, the sectors experiencing the greatest decline in added value in regions other than Shanghai were related to wholesale and retail trade. The largest decrease, however, was observed in the manufacturing of metal products, machinery, and equipment repair services. Zhejiang was the province with the greatest effects, with a decrease of 3.2%, and Guangdong had the largest added value losses (5.002 billion US dollars). Third, the impact of Shanghai’s lockdown on other regions was not significantly influenced by its economic size or geographical location.

We propose the following policy recommendations for responding to emergencies.

First, when regional production activities are suppressed due to natural disasters, wars, or regional regulations, their economic impact spreads to other regions of the country through the national production network and leads to unexpected economic losses. It is necessary to consider this type of collective loss in disaster responses and decision-making and take more cautious and optimized measures. Differentiated measures for key sectors and sectors in disaster-stricken areas may help minimize economic losses within and outside the region as much as possible.

Second, there are significant structural differences in the impacts of emergencies on affected areas and various sectors outside the region. When preventive and remedial measures are implemented, structural measures that focus on specific sectors within the supply chain and value chain are more effective than universal measures are. Policy support such as financial subsidies, tax reductions, and low interest loans should be provided to severely affected industries such as transportation, warehousing, postal services, leasing, commercial activities, metal product manufacturing, and metal product maintenance services. Additionally, the government should establish a more comprehensive financial emergency response mechanism to ensure the continuity and stability of financial services during emergencies. Strengthening regional industrial chain coordination and emergency response mechanisms, promoting diversified development of the supply chain, and reducing reliance on a single market are suggested. Furthermore, according to the characteristics of different industries, the government should introduce targeted support measures; leverage various industry guidance funds and special funds for industrial development; and focus on supporting export-oriented manufacturing, tourism services, transportation services, and other industries that have been greatly affected by the epidemic to overcome difficulties.

Third, owing to significant variations in the impact on regions, regional policies implemented by local governments are typically more focused, adaptable, and effective than universal policies implemented by the central government. Policies targeting critical sectors and enterprises can be implemented by the central government.

Fourth, the economic impact pathways between regions and sectors are relatively complex, and different regions and sectors that do not have obvious direct connections may still be affected. Therefore, when evaluating the impact and formulating countermeasures, it is necessary to consider not only the directly affected sectors and enterprises but also the sectors and enterprises that may be significantly indirectly affected by the supply chain and value chain.

Fifth, regional economic resilience should be enhanced not only by improving a region’s ability to resist risks but also by establishing a unified domestic market and promoting regional economic integration and development. This helps minimize the impact of external emergencies on a region’s economy. In practice, blindly strengthening supply chain localization in regions can actually increase the risk of local emergencies. Only by decentralizing the upstream sources and downstream destinations of the supply chain can we effectively reduce supply chain risks both within and outside the domain.

Sixth, for the overall domestic economy, establishing a unified market and promoting effective interregional market competition can facilitate the dispersion of the domestic supply chain, thereby enhancing resilience against regional emergencies.

Owing to factors such as the author’s knowledge, data availability, and space limitations, there are still some shortcomings in this article. First, compared with the input‒output table obtained via a survey, the input‒output table obtained via the RAS method has gaps in terms of the research accuracy. Second, owing to space limitations, this article analyzes only the added value as an indicator. The impacts on important economic indicators related to the national economy and people’s livelihoods, such as taxation, employment, and carbon emissions, need further exploration. Finally, this article quantitatively analyzes the extraterritorial impact of Shanghai’s lockdown, but further research is needed on the subdivided characteristics of the impact. In the future, we will pay more attention to the impact of regional emergencies on external fiscal revenue, residents’ employment, consumer sentiment, sectoral recovery, and the atmospheric environment. For example, in terms of employment, COVID-19 caused enterprise closures and reduced recruitment, resulting in an overall decline in the employment rate. The uncertainty brought about by the epidemic caused consumers to worry about future economic prospects, leading them to reduce unnecessary expenditures and opt for more affordable and economical goods and services. Furthermore, as the situation was brought under control, sectoral production has gradually recovered. However, the growth rate of sectoral production is significantly faster than that of investment demand, consumer demand, and export demand, leading to a continuous exacerbation of oversupply. In addition, the characteristics, paths, and effective measures for the recovery of the regional and national economy after the impact of emergencies are also key areas of focus.

Data availability

All data are available. The data used in this article can be obtained from the dataset, which includes the inter provincial multi regional input-output table in 2017. The data is available in the Harvard Dataverse repository, https://doi.org/10.7910/DVN/HZKNMM.

References

Alam I, Ali Y (2023) Studying the effects of Türkiye earthquake disaster and its impact on real estate industry: A risk analysis based on input-output & non-linear optimization models. Int J Disaster Risk Reduct 96:103920

Ambrus A, Field E, Gonzalez R (2020) Loss in the Time of Cholera: Long-Run Impact of a Disease Epidemic on the Urban Landscape. Am Econ Rev 110:475–525

Arto I, Andreoni V, Rueda Cantuche JM (2015) Global Impacts of the Automotive Supply Chain Disruption Following the Japanese Earthquake of 2011. Econ Syst Res 27(3):306–323

Balsa-Barreiro J, Li Y, Morales A, Pentland AS (2019) Globalization and the shifting centers of gravity of world’s human dynamics: implications for sustainability. J Clean Prod 239:117923

Balsa-Barreiro J, Vié A, Morales AJ, Cebrián M (2020) Deglobalization in a hyper-connected world. Palgrave Commun 6(1):28

Bi M (2023) Impact of COVID-19 on environmental regulation and economic growth in China: A Way forward for green economic recovery. Econ Anal Policy 77:1001–1015

Brainard J, Jones NR, Harrison FCD, Hammer CC, Lake LR (2023) Super-spreaders of novel coronaviruses that cause SARS, MERS and COVID-19: a systematic review. Ann Epidemiol 82:66–67

Caccioli F, Shrestha M, Moore C, Farmer JD, Caccioli F, Shrestha M, Moore C, Farmer JD (2012) Stability analysis of financial contagion due to overlapping portfolios. Working paper 2012-10-018, santa fe institute. J Bank Financ 46(3):233–245

Chan YT (2022) The macroeconomic impacts of the COVID-19 pandemic: A SIR-DSGE model approach. China Econ Rev 71:101725

Chen XK (2011) Input-output technology. Science Press

Degryse H, Huylebroek C (2023) Fiscal support and banks’ loan loss provisions during the COVID-19 crisis. J Financ Stab 67:101150

Galbusera L, Giannopoulos G (2018) On input-output economic models in disaster impact assessmen. Int J Disaster Risk Reduct 30:186–198

Han Y (2022) The impact of the COVID-19 pandemic on China’s economic structure: An input–output approach. Struct Change Econ Dyn 63:181–195

Henderson D, Courtney B, Inglesby T, Toner E, Nuzzo J (2009) Public health and medical esponses to the1957–58 influenza pandemic. Biosecur Bioterror 7:265–273

Ichev R, Marinč M (2018) Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. Int Rev Financ Anal 56:153–166

Isard W (1951) Interregional and regional input-output analysis: a model of a space-economy. Rev Econ Statist 33(4):318–328

Islam MZ, Wang C (2024) Cost of high-level flooding as a consequence of climate change driver?: A case study of china’s flood-prone regions. Ecol Indic 160:111944

Janssen M, Voort H (2020) Agile and adaptive governance in crisis response: Lessons from the COVID-19 pandemic. Int J Inf Manag 55:102180

Jia Z, Wen S, Lin B (2021) The effects and reacts of COVID-19 pandemic and international oil price on energy, economy, and environment in China. Appl Energy 302:117612

Kancs DA (2024) Uncertainty of supply chains: Risk and ambiguity. World Econ 47(5):2009–2033

Kazancoglu Y, Ekinci E, Mangla SK, Sezer MD, Ozbiltekin-Pala M (2023) Impact of epidemic outbreaks (COVID-19) on global supply chains: A case of trade between Turkey and China. Socio-Econ Plan Sci 85:101494

Leontief W (1986) Input–output economie. Oxford university press

Li M, Li Q, Wang Y, Chen W (2022) Spatial path and determinants of carbon transfer in the process of inter provincial industrial transfer in China. Environ Impact Assess Rev 95:106810

Li ST, Pan H, He JW, Chen J (2021) China’s inter-provincial input-output table in 2017. Economic Science Press

Li Z, Pei S, Li T, Wang Y (2023) Risk spillover network in the supply chain system during the covid-19 crisis: evidence from china. Econ Model 126:106403

Li Z, Zhou Q, Chen M, Liu Q (2021) The impact of COVID-19 on industry-related characteristics and risk contagion. Financ Res Lett 39:101931

Liu Y, Wang J, Wang X, Wu H, Guo F, Song Y (2022) A study of CO2 emissions in China’s domestic construction industry based on non-competitive input-output. Sustain Prod Consum 32:743–754

Ma D, Zhu Y (2024) The impact of economic uncertainty on carbon emission: evidence from china. Renew Sustain Energy Rev 191:114230

Makower HBB (1969) Trade Liberalization among Industrial Countries: Objectives and Alternatives. Atlantic Policy Study. Econ J 79:142–143

Mirto S, Montalto V, Mangano MCM, Ape F, Berlino M, La Marca C, Lucchese M, Maricchiolo G, Martinez M, Rinaldi A, Terzo SMC, Celic I, Galli P, Sarà G (2022) The stakeholder’s perception of socio-economic impacts generated by COVID-19 pandemic within the Italian aquaculture systems. Aquaculture 553:738127

Novelli M, Burgess LG, Jones A et al. (2018) ‘No Ebola…still doomed’ - The Ebola-induced tourism crisis. Ann Tour Res 70:76–87

Obrien E, Hajializadeh D, Power R (2015) Quantifying the impact of critical infrastructure failure due to extreme weather events. In: 12th International Conference on Applications of Statistics and Probability in Civil Engineering

Ouyang M (2014) Review on modeling and simulation of interdependent critical infrastructure systems. Reliab Eng Syst Saf 121:43–60

Prager F, Wei D, Rose A (2017) Total Economic Consequences of an Influenza Outbreak in the United States. Risk Anal 37(1):4–19

Santos J (2020) Using input-output analysis to model the impact of pandemic mitigation and suppression measures on the workforce. Sustain Prod Consum 23:249–255

Santos MCD, Magano J, Mota J (2023) The impact of the Covid-19 pandemic on the hotel Industry’s economic performance: Evidence from Portugal. Heliyon 9(5):e15850

Stone R (1962) Multiple classifications in social accounting. Bull Inst Int Stat 39:215–233

Sung H, Dabrundashvili N, Baek S (2023) Mode-specific impacts of social distancing measures on the intra- and inter-urban mobility of public transit in Seoul during the COVID-19 pandemic. Sustainability Cities Soc 98:104842

Tian KL, Zhang ZY, Zhu LX, Yang CH, He JW, Li ST (2022) Economic exposure to regional value chain disruptions: evidence from Wuhan's lockdown in China. Reg Stud 57(3):1–12

Tokui J, Kawasaki K, Miyagawa T (2016) The economic impact of supply chain disruptions from the Great East-Japan Earthquake. Japan World Econ 37:1–9

Wen W, Li Y, Song Y (2022) Assessing the negative effect” and positive effect” of COVID-19 in China. J Clean Prod 375:134080

World Bank (2014) Ebola: economic impact already serious; could be catastrophic without swift response

Wu X, Zhang Y, Feng X (2023) The impact of Japanese nuclear wastewater discharge into the sea on the global economy: Input-output model approach. Mar Pollut Bull 192:115067

Yu KDS, Aviso KB, Santos JR, Tan RR (2020) The Economic Impact of Lockdowns: A Persistent Inoperability Input-Output Approach. Economies 8(4):109

Zhang M, Zhang Z (2023) Spatial correlation network of urban economic resilience in the Yangtze River Delta urban agglomeration. Geogr Geo-Inf Sci 39(01):69–79

Zhang Y, Sun B, Xie R (2021) Study on decomposition and countermeasures of the economic impact of Covid-19. Stat Res 38(08):68–82

Zhou X, Jing D, Dai L, Wang Y, Guo S, Hu H (2022) Evaluating the economic impacts of COVID-19 pandemic on shipping and port industry: A case study of the port of Shanghai. Ocean Coast Manag 230:106339

Zhou X, Lei K (2020) Influence of human-water interactions on the water resources and environment in the Yangtze River Basin from the perspective of multiplex networks. J Clean Prod 265:121783

Zhuang T, Zhao S (2022) Collaborative innovation relationship in Yangtze River Delta of China: Subjects collaboration and spatial correlation. Technol Soc 69:101974

Acknowledgements

This work was supported by National Natural Science Foundation of China (42401374, 72074181), and President’s Youth Fund of Institutes of Science and Development, Chinese Academy of Sciences (E3X3251Q).

Author information

Authors and Affiliations

Contributions

Conceptualization: ZML Methodology: ZML and YNW and XYH. Sourcing for research materials: ZML, YNW, XYH, and ZHZ Writing—original draft: ZML, YNW, ZHZ and QSL Writing— review and editing: ZML, YNW, ZHZ, XYH, QSL and ML Visualization: ML.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Liu, Z., Wang, Y., Huang, X. et al. Assessment of national economic repercussions from Shanghai’s COVID-19 lockdown. Humanit Soc Sci Commun 11, 1579 (2024). https://doi.org/10.1057/s41599-024-04100-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04100-3